Summary:

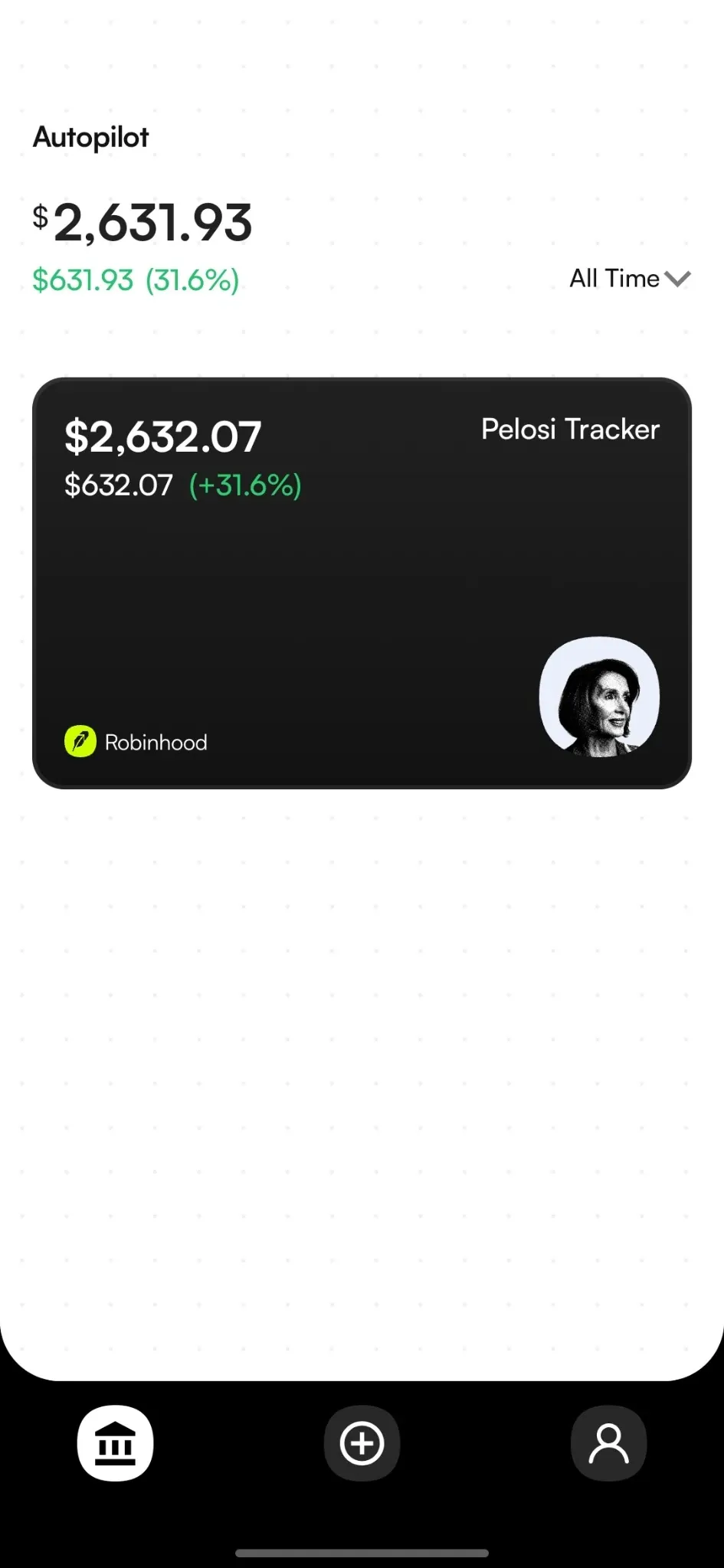

I linked Robinhood, copied the Pelosi Tracker, and my $2,000 became $2,632.07 (+31.6%, and a money-weighted return of ~166.4% annualized) with zero manual orders. AutoPilot is free to explore; but full automation/premium portfolios require a paid plan. Best as an add-on to your existing personal finance tools for controlling ~5-15% of your financial portfolio.

Pros

- Real auto-trading & rebalancing in your broker

- Easy broker link (Robinhood worked flawlessly for me)

- Good discovery (Top Performers, Most Popular, Trending)

- "Blacklist" feature to avoid overexposure and overhyped stocks

Cons

- Theme/concentration risk (AI, defense, etc.)

- Costs can stack (base {$99/yr} + creator {$99-$299/yr} + taxes)

- Tracking error vs headline performance

- Rebalances can create taxable events

Why AutoPilot

I’m busy, allergic to spending hours researching stocks, and deeply suspicious of experts preaching about "hot new stocks." So I ran a live experiment with AutoPilot, the personal-finance app that lets you subscribe to public model portfolios—called Pilots—and then auto-copy their buys/sells inside your own brokerage.

I connected my Robinhood account, deposited $2,000 in two $1,000 chunks, and subscribed to the Pelosi Tracker to see if the pitch—“outperform the market with hands-off execution”—was more than a meme. A few months later, my AutoPilot card showed $2,632.07, up +31.6% from my funding total, without me lifting a finger.

Was that timing luck? Partly. Was the experience genuinely “set it and forget it”? Shockingly, yes. Below is exactly how I set it up, what I owned, and how the results stacked up.

My Testing Approach

Test window & funding cadence: I funded twice: $1,000 on March 28 and $1,000 on August 18. That spacing gives a realistic read on timing risk—the biggest reason copy-trading results can differ from headline charts. I did not top up in between and I didn’t manually intervene in trades.

Broker connection: I linked Robinhood once at setup; all orders executed there (not inside of Autopilot). I never transferred assets out of my broker or gave up custody.

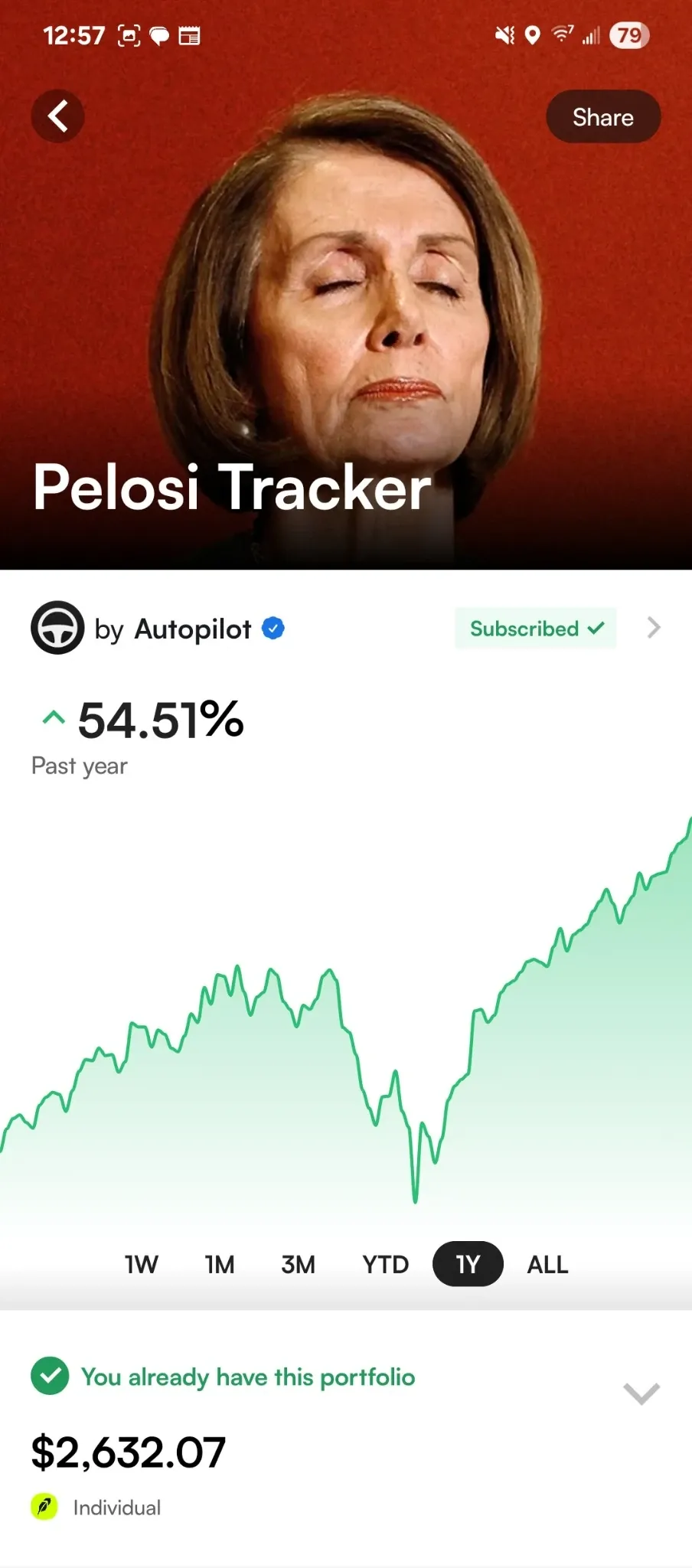

Pilot selection: I chose the Nancy Pelosi Tracker for three reasons:

- It’s consistently in Most Popular, so incentives exist for its creators to keep it fresh.

- It has a clear mega-cap growth tilt that fits my portfolio as a satellite sleeve.

- It supports full automation (some creator/portfolio combos are view-only unless you subscribe).

- Nancy Pelosi, former Speaker of the House, and a current US Senator has become famous in finance circles not just for politics, but for her household’s uncanny stock-picking. Over the past few years, trackers of her disclosed trades show she’s often beaten the S&P 500 by 20–30%+ in certain periods. Of course, she insists it’s all just sharp investing skill—and definitely not insider trading. 🤔🤔🤔

Success criteria:

- Outcome: Did my account value beat a simple index funded on the same dates?

- Effort saved: Did AutoPilot actually reduce the number of actions I’d otherwise take (orders, rebalances, allocations)?

- Tracking quality: Did my holdings stay “Up to Date” with the Pilot after changes?

Data source & caveats. All results are live account values shown inside AutoPilot/Robinhood. No backtests. Your mileage will vary depending on when you fund, slippage, creator changes, taxes, and fees.

Note on returns: In the performance section below I report both money-weighted returns (IRR/XIRR) and a time-weighted proxy (Modified Dietz) so readers can compare results fairly despite mid-period deposits.

How to Get Started

Account creation: Email + password; and of course I turned on 2FA.

Connect brokerage account: From Brokerage Accounts I tapped Robinhood, used the standard OAuth-style login, confirmed read/trade permissions, and was linked in under a minute.

Browse & subscribe: I opened Portfolios → Pilots, scanned Top Performers and Most Popular, then tapped Pelosi Tracker. I confirmed the subscription (automation requires a paid tier; pricing details below).

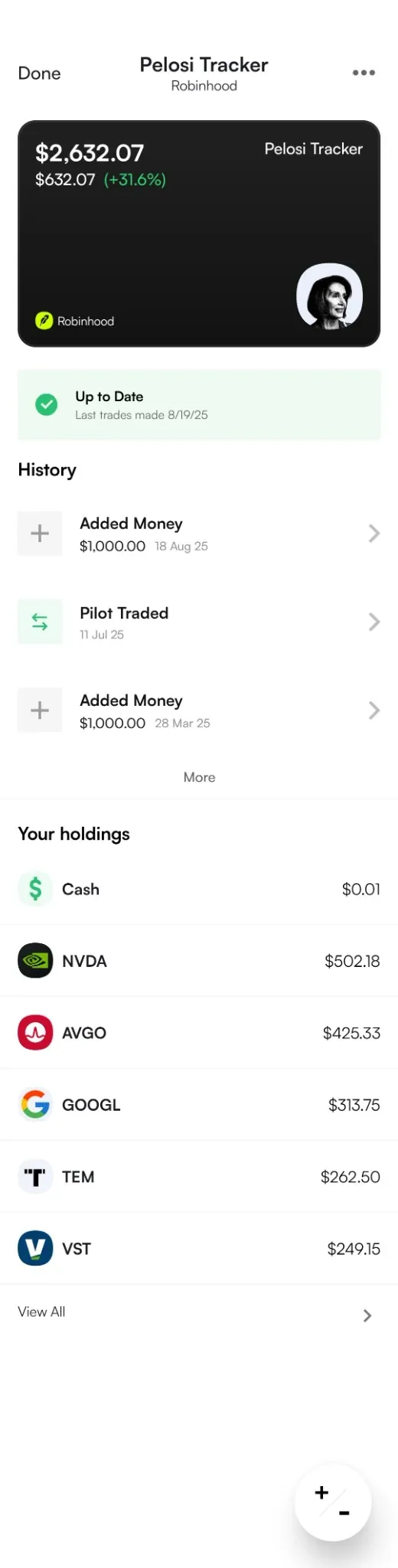

Fund the strategy: I deposited $1,000. A green banner soon read “Up to Date — last trades made …” which is AutoPilot-speak for “we mirrored your Pilot.”

Trade history receipts: Inside History I saw Added Money $1,000 (Mar 28), Pilot Traded (Jul 11), and Added Money $1,000 (Aug 18). These entries are your audit trail and help me understand what actions I've taken.

Quality-of-life guardrail: Blacklist. From any holding, I can tap Add to Blacklist to exclude a ticker from future buys. If you’re already loaded with NVDA via RSUs, this keeps the Pilot from piling on more. Though I did not use this feature.

Exploring Portfolios

AutoPilot’s discovery layer is equal parts useful and entertaining:

- Top Performers: Leaderboards sortable by 1W / 1M / 3M / 6M / 1Y. Short windows flag momentum; longer windows help you avoid heat-chasing.

- Most Popular: Ranked by total dollars invested—a quick wisdom-of-crowds signal.

- Trending / New: What the community is sampling now—good for idea serendipity.

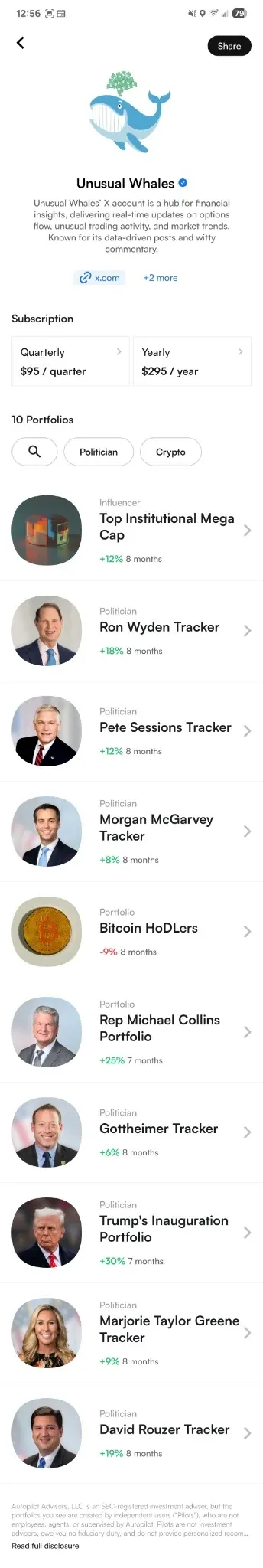

- Creator storefronts: Some brands (e.g., Unusual Whales) offer multiple Pilots with their own subscription options (theirs is $295/year).

What I considered before landing on Pelosi:

- Jim Simons Tracker — great brand association, but I wanted mega-cap clarity and lower turnover.

- Inverse Cramer — hilarious, but I treat it as a novelty sleeve.

- World War III Portfolio — topical defense tilt; useful as a macro hedge, not my main satellite. And, on principal, I hope this doesn't perform well.

Ultimately, Pelosi Tracker gave me a conviction-weighted growth mix that complements my core index funds without turning my whole portfolio into a niche bet. Popularity also implied better creator upkeep.

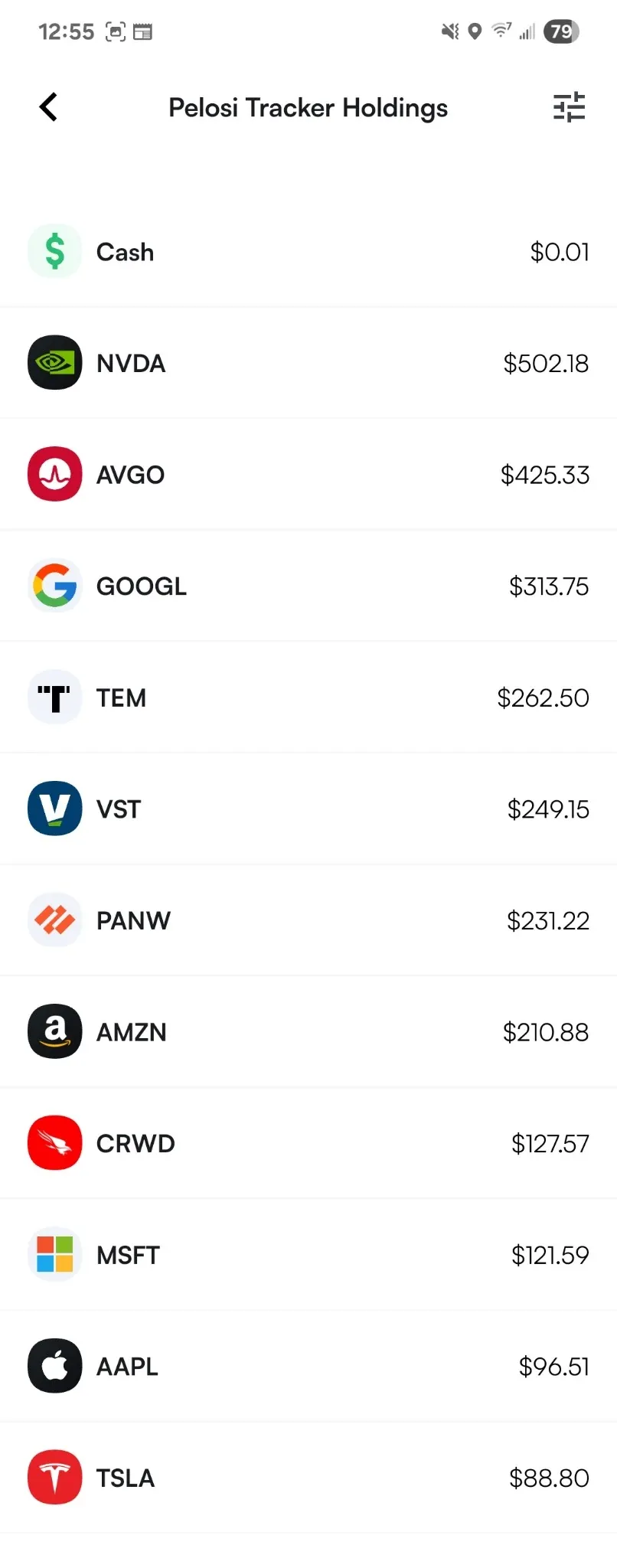

Holdings Analysis

Here’s a snapshot of what AutoPilot placed in my Robinhood account after funding and subsequent rebalances (dollar amounts reflect the holdings screen at the time of my screenshot):

- NVDA — $502.18

- AVGO — $425.33

- GOOGL — $313.75

- TEM — $262.50 (thematic/experimental satellite)

- VST — $249.15 (power/utility tilt; helpful defensively)

- PANW — $231.22

- AMZN — $210.88

- CRWD — $127.57

- MSFT — $121.59

- AAPL — $96.51

- TSLA — $88.80

What this mix tells me

- AI core + cloud edge. NVDA/AVGO power the AI build-out; MSFT/GOOGL/AMZN monetize it through cloud + ecosystem.

- Cybersecurity beta. PANW/CRWD add secular security demand on top of growth.

- Barbell with utilities/defensives. VST dampens volatility when growth gets choppy.

- Idiosyncratic spice. TEM-style smaller positions give optionality—the Pilot’s “ideas budget.”

Why blacklist matters. If your personal stack already includes heavy AAPL/MSFT or concentrated NVDA, use Blacklist to stop AutoPilot from automating into over-concentration. You still track the Pilot—just without those names—and AutoPilot redistributes the weight across the remaining holdings.

Did I Make Me Money?

My deposits:

- $1,000 on Mar 28

- $1,000 on Aug 18

My value at snapshot

- $2,632.07, showing +$632.07 (+31.6%) all-time and a money-weighted return of ~166.4% annualized)

How I interpret that

- Timing luck is real. The spring and late-summer entries caught favorable windows for AI-led mega caps. Fund during a drawdown and your early chart can look different.

- Automation did the unsexy work. Instead of entering a dozen tickets and rebalancing whenever the Pilot tweaked weights, AutoPilot executed changes and showed a single “Up to Date” confirmation.

- Tracking dispersion. You won’t match a creator’s headline chart perfectly. Funding date, cash drag, and trade windows create tracking error—a fair trade for the time saved.

Returns math: Money-weighted vs Time-weighted

Because I funded twice (Mar 28 and Aug 18), I’m showing both styles:

- Actual return: $2,632.07, showing +$632.07 (+31.6%)

- Money-weighted return (IRR/XIRR), annualized: ~166.4%

- Money-weighted over the actual period (167 days): ~+56.6%

- Time-weighted (Modified Dietz proxy for this period): ~+55.3%

Why so many? Actual-return shows how much I earned in simple dollars. Money-weighted reflects your specific cash-flow timing (great for “what I earned” when compared to a generalized reference point - like how the S&P 500 returns ~10% per year on average). Time-weighted strips out timing effects to isolate strategy performance (great for comparison across investors).

For a sanity check, compare your funded-on-those-dates return to simple alternatives like S&P 500 (SPY) or Nasdaq-100 (QQQ). For me, the extra return + zero manual effort cleared the bar—especially as a satellite sleeve riding on AI strength.

Free vs Paid

| Feature | Free | Paid |

|---|---|---|

| Browse portfolios & performance charts | ✅ | ✅ |

| Auto-trading & auto-rebalancing in your broker | ❌ | ✅ |

| Access to premium creator portfolios | ❌ | ✅ (varies by creator) |

| Blacklist tickers (exclude holdings) | View only | ✅ |

| Support priority | Standard | Priority / varies |

AutoPilot gives you a nice on-ramp: you can download and explore for free, but to unlock the real magic—automated trades and premium portfolios—you’ll need a paid plan.

- Free tier: lets you browse portfolios, read their strategy blurbs, view performance charts, and compare rankings (Top Performers, Most Popular, Trending). Great for window shopping.

- Paid tier: unlocks full auto-trading + auto-rebalancing in your connected broker, plus access to premium Pilots.

- Creator subscriptions: some portfolio creators (like Unusual Whales) add their own subscription pricing on top of AutoPilot’s base.

A simple way to think about it: if automation saves you more money (or time) than the subscription costs, it’s worth it. Example: say the service is $99/year. If you invest $2,000, you’d need just +4.5% extra return versus doing nothing—or enough time saved that you don’t mind the fee.

Risks

No app eliminates risk, and AutoPilot is no exception. Here are the big ones I noticed:

- Concentration risk: Many Pilots lean heavily into a theme (AI, defense, mega-cap growth). If you copy them, you inherit that bet. Most portfolios are inherently concentrated.

- Creator risk: Pilots are managed by independent creators. A strategy that worked last quarter might stall, and you can’t control their timing.

- Taxable events: Rebalances trigger capital gains tax. Not ideal if you're a longterm investor.

- Tracking error: Your results may differ from the “headline” charts depending on when you fund, how much, and whether you blacklist tickers.

- Costs stack: Base subscription + possible creator fees + trading-related taxes can add up.

Guardrails to help manage risk:

- Use the Blacklist feature to remove tickers you’re overexposed to.

- Limit your allocation (e.g., 5–15% of your portfolio) so AutoPilot is a satellite sleeve, not your core portfolio driver.

- Dollar-cost average in over time instead of lump-sum investing.

Getting the Most Value

If you’re going to use AutoPilot seriously, here are three pro workflows worth considering:

1. The Satellite Sleeve Play: Keep your main assets in simple, broad ETFs or index funds. Allocate 5–15% into an AutoPilot strategy (like Pelosi Tracker or Inverse Cramer) as your “spicy sleeve.” This gives you exposure to active ideas without risking your whole portfolio.

2. The Multi-Pilot Blend: Combine complementary Pilots—e.g., one growth-heavy (AI/tech) with one dividend/defensive. That way, you’re not at the mercy of a single theme.

3. The Dollar-Cost Averaging Cadence: Instead of dumping $5k at once, drip-feed $250–$1,000 per month/quarter. AutoPilot will auto-allocate your fresh cash into the Pilot’s mix, smoothing out timing risk.

My rule of thumb:

Keep AutoPilot as a minority percentage (5–15%) of your portfolio - alongside a diversified core. DCA your adds, and Blacklist any tickers you’re already overweight in or feel are overhyped.

Is AutoPilot Right for You?

Great fit if you are:

- A busy professional who wants hands-off exposure to themes or strategies.

- Someone new to investing who learns better by copying a consistent process than going fully DIY.

- An intermediate investor looking to add a tactical sleeve to an otherwise diversified core portfolio.

Probably not for you if you are:

- A DIY stock-picker who wants full control over every trade.

- A tax minimizer who hates capital-gain-triggering rebalances.

- Someone who already has access to professional money managers and doesn’t need another layer of automation.

AutoPilot FAQs

Do I keep custody of my assets? Yes. Your stocks and cash stay in your connected broker (Robinhood, etc.). AutoPilot just executes orders on your behalf.

Can I pause or stop trading? Yes. You can unsubscribe from a Pilot or disconnect your broker. Your positions remain in your account.

What happens if a Pilot makes big changes overnight? AutoPilot will queue trades to mirror those changes. Expect a burst of orders, especially during rebalances.

Will my results match the Pilot’s performance chart exactly? Not necessarily. Funding date, order timing, and blacklisting affect your personal results.

Does AutoPilot work in retirement accounts? Yes, if your broker allows third-party trading connections in those accounts.

How often does it rebalance? It depends on the Pilot. Some change monthly, others only when conviction shifts. You’ll see “Up to Date” when your account matches their current allocations.

What Changes I'd like To See

While Autopilot is already great, I’d love a few additional power-user upgrades. First, clearer pre-trade transparency—a preview that estimates tracking error, expected slippage, and any taxable gains a rebalance could trigger, plus a simple benchmark overlay, would help users judge whether to execute now or wait.

Second, more portfolio controls: caps on single-ticker weight, optional DCA auto-funding, and a toggle for “rebalance only above X% drift.”

Third, smarter portfolio management between strategies—an in-app “roll” that automatically and tax-aware moves me from one Pilot to another (or consolidates multiple Pilots) keeps the experience truly hands-off; this echoes user feedback asking for rolling and consolidation flows that I've seen on Reddit.

Finally, open the door to community-curated Pilots with lightweight guardrails and public performance/audit trails (timestamped changes vs. fills); creators already play a big role on the platform, so expanding that ecosystem—while adding stronger disclosure—would compound network effects.

Given the app’s strong ratings and rapid adoption, these tweaks would shift AutoPilot from great automation to institutional-grade automation for retail.

Conclusion

AutoPilot nails the two hardest parts of copy-trading: execution and maintenance. My Robinhood link was painless, and my real-money test with $2,000 in the Pelosi Tracker ended up +31.6% to $2,632.07—all on autopilot, or ~166.4% annualized.

It’s not magic. You’re still taking on creator risk, concentration, and taxable events. But if you like the idea of hands-off investing in curated strategies, AutoPilot delivers exactly what it promises.

Bottom line: Download the app, explore for free, then decide if upgrading for automation and premium portfolios is worth it. Start small, use the Blacklist to avoid overexposure, and treat AutoPilot as an add-on tool, not a crystal ball.

For inquiries or collaboration: Email adam@adamtreister.com — I personally read every message.